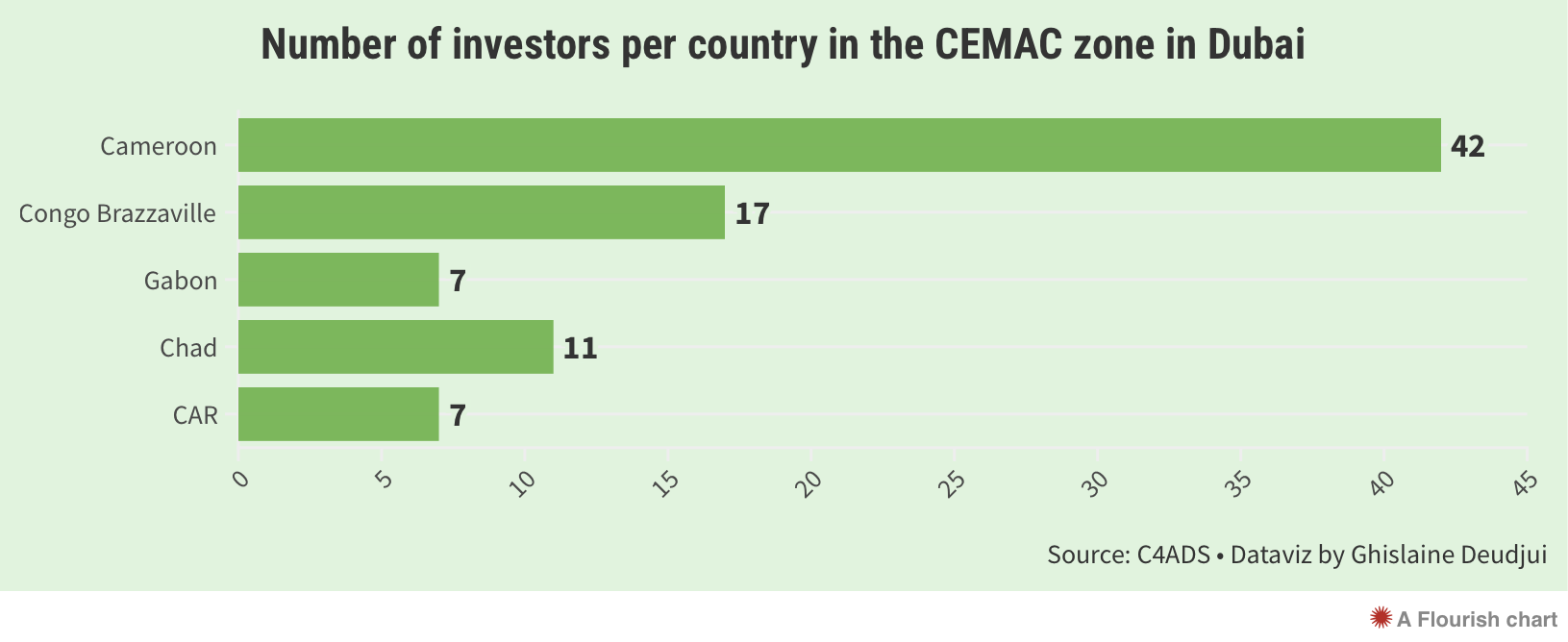

72 ministers, mayors, members of parliament and businessmen from Cameroon, Gabon, Chad, Congo and the Central African Republic, a devastatingly poor central region on the African continent, owned high-end properties in posh neighbourhoods in Dubai, United Arab Emirates in the 2019-2020 period.

These findings are the result of an eight-month long search, ending in February 2023, of the database of the Center for Advanced Defense Studies (C4ADS), a US-based organisation that “combats illicit networks that threaten peace and security around the world.” Over 2019 and 2020, C4ADS identified investors from the Economic and Monetary Community of Central African States (CEMAC), except for Equatorial Guinea, in Dubai. Their occupations range from businessmen to well-known private individuals, politicians, members of the government, local councillors, magistrates, and general managers, as well as their spouses, children, and relatives.

Eight flats worth US$ 15 million

Among the African Dubai property owners is Cameroonian ruling party MP and businesswoman Moufta Halia Moussa, whose eight flats are estimated to be worth more than US$ 15 million. Also in the database is Chadian businessman Hissein Bourma Ibrahim, a former director of the Société des Hydrocarbures du Tchad and brother-in-law of the late Chadian President Idriss Déby. Bourma Ibrahim, owns a villa, seven flats and a shopping centre, estimated to be worth over US$ 7 million.

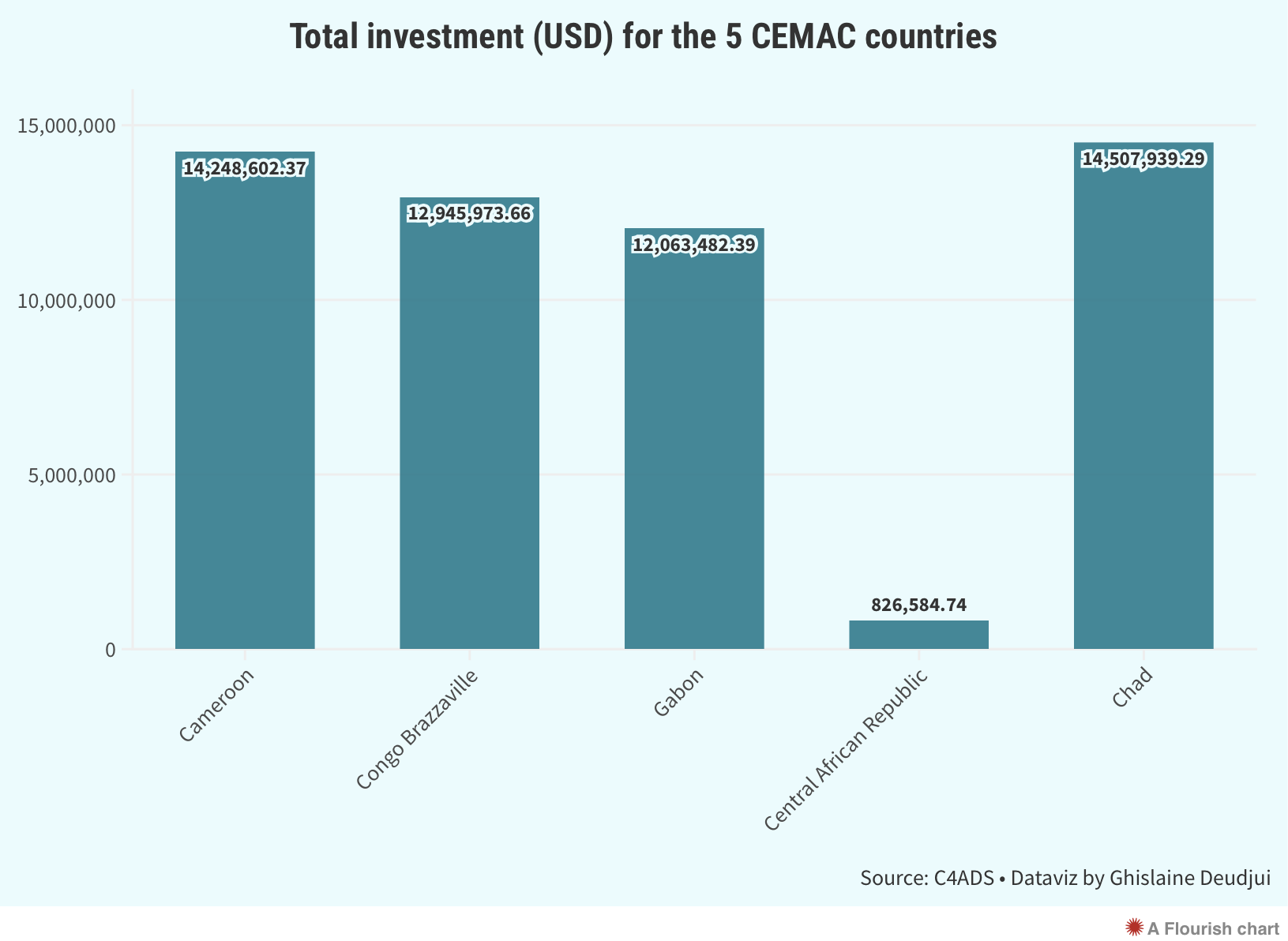

Other members of the family of the late president, including his elder brother Daoussa Idriss – all linked to the management of oil revenues and finances in Chad – spent more than US$ 2,3 million on flats in upmarket areas such as Business Bay and Al Warsan First in Dubai. The total value of Chadian investments in the city is estimated to be US$ 14,5 million.

The president's daughter-in-law owns fifteen houses

Former President of the Constitutional Court of Gabon Marie Madeleine Mborantsuo (commonly known as “3M”) and her children own numerous villas and flats, with an estimated joint value of US$ 3,5 million, in Dubai. Other Gabonese Dubai property owners in the database are relatives of politicians and members of government, with assets amounting to more than US$ 12 million. Among the Congolese included in the database are several close associates of the octogenarian President of the Republic of Congo, Dénis Sassou Nguesso. Fifteen properties estimated at US$ 9,5 million belong to Blandine Malila Lumande, Sassou-Nguesso’s daughter-in-law, and five, with a value of close to US$ 2 million, to Raymond Zephirin Mboulou, who has been Congo’s Minister of the Interior since 30 December 2007.

State contract benefits

A now-deceased Cameroonian, former honorary Consul General for South Korea, Mohamadou Dabo, owned an apartment in the Burj Khalifa, the world's tallest building, valued at over US$ 510,000 at the time of data collection. According to earlier reports in Cameroon, Dabo’s company Moda Holding Corporation benefited from numerous state contracts, including a Covid-19 supply tender of over US$ 40 million which was cited in a report by the Cameroonian Audit Bench as “suspect”. In 2020, the late honorary diplomat led a delegation of officials from the British investment firm The First Group to Cameroon, to present investment opportunities in Dubai's real estate sector.

There may be many more high-profile individuals from central African countries in the database, but it is difficult to trace all of them. This is because, in the words of public governance expert and political science lecturer at the University of Douala, Dr Louison Essomba, “these public figures generally use fake names, which may be of their friends, relatives or children.” Our research was nevertheless able to link 117 assets, jointly estimated at US$ 54 million, to officials, politicians, and leading businessmen in the above-mentioned countries.

The investments guarantee a residence permit

Cameroonian representative of investment consulting firm Lagertha Africa, Joseph Lwanga Nguefack Sonkoué, says he is not surprised by the flocking of prominent African personalities and their assets to Dubai. “It has been aggressively promoting foreign investment for some years now. It was a desert just a few decades ago! These investments, particularly in real estate, are accompanied by incentives for residence permits and the like. This gives a choice to every African who can afford this luxury to take advantage to guarantee themselves a stay there.” Fellow Cameroonian and business lawyer Jacques Jonathan Nyemb adds, “Investing in Dubai is not in itself a reprehensible act, a criminal act or an act of tax evasion … The question here is whether the funds have a credible, dubious, or fraudulent origin.”

Illicit enrichment

Commenting further, Dr Essomba explains that “a specific law applies to officials who (invest) in a foreign country. If there were good governance and the application of the law on the declaration of assets and wealth – which, in my opinion, is the barometer of the fight against corruption and illicit enrichment – then we would have to track down all those who enrich themselves on the back of the state's wealth.”

Despite the existence of such laws in all four above-mentioned countries, most CEMAC politicians and functionaries have not declared their assets. Jean Mballa Mballa, Executive Director of the African Regional Center for Endogenous and Community Development (CRACEC) and member of the Extractive Industries Transparency Initiative (EITI)’s Cameroon Committee, points out, “It is worrying to see public officials such as members of parliament, heads of state and judges investing in Dubai without a clear declaration of their assets, especially when the origin of their wealth cannot be traced.”

Dubai is the new El Dorado

“Oligarchs from Central Africa are fleeing … because their operations are not justified. Dubai is a financial center for money laundering and trading in metals from Africa,” says Andréa Gombet, an activist and founder of the Sassoufit collective, an organisation that brings together citizens against kleptocracy. The view is shared by Claude Hyepdo, coordinator of Transparency International Cameroon, who comments, “Dubai has become the new Eldorado for our authorities, especially given its very discreet nature. What's more, it's the main market for Cameroonian gold.”

The CADTM Network Platform, an international movement fighting for the abolition of illegitimate debts, states in an article on its website that “the European Union has estimated that stolen African assets held in foreign bank accounts are equivalent to more than half of the continent's external debt. Every year, Africa loses an estimated US$ 88,6 billion to illicit capital flight, equivalent to 3,7% of the continent's gross domestic product (UNCTAD, 2020).”

Enormous financial flows

Following the publication of this report in 2021, Cristina Duarte, Under-Secretary-General of the United Nations, and Special Adviser for Africa, has said that “the 88,6 billion dollars that Africa loses each year is not just a figure. It must be seen in terms of missed development opportunities, lost livelihoods, and increased poverty.” In Chad, for example, “the consequences of the exploitation of Chadian oil have been followed by enormous financial flows,” explains Nadibigue Pinah Padja, President of the NGO Transparence+, an organisation that fights corruption in Chad. “This internal resource has created a social imbalance and has only enriched the elites in power. This illicit enrichment is most often channelled through state entities such as customs, tax authorities, and the awarding of major contracts. Several reports show that these sums are invested in tax havens to the detriment of local development.”

“You got the wrong person”

Cameroon’s Directorate General of Taxes did not respond to any communications (sent by email, telephone, and WhatsApp), in which we asked whether there are any provisions governing this type of investment, and whether there are any Cameroonian investors whose funds may be of dubious origin.

Contacted by telephone, Congo’s Interior Minister Raymond Zephirin Mboulou said that “you got the wrong person” and that he has “no assets in Dubai.” Cameroonian MP Moufta Halia Moussa, when reached by phone, asked us to call her back. However, this attempt and all our other attempts to contact her again by phone, or WhatsApp, over the next several weeks were unsuccessful.

Cameroonian Pouma Municipality mayor Dorothée Nyodog-Ngo Mboua, who owns a Dubai flat valued at over US$ 200,000, responded to a phone call saying: “I can't answer, I'm in a meeting.” When we suggested calling her back later, Mrs Nyodog pointed out that she was very busy and that the “network might be unstable” for the next call. We contacted her again the following day but were again told that she was “in a meeting” and asked to call back between 5 and 6 pm. When we tried to phone at that time, her phone was off.

This work was carried out as part of the ODACA project, initiated by ADISI-CAMEROUN with technical support from C4ADS and financial backing from OSIWA.The original article has been edited by ZAM